Budget Updates 2021

The Last Date for filing belated, revised return is proposed to be reduced by three months in Budget 2021 from March 31 of the relevant assessment year to Dec 31 of the assessment year. As per the proposal, this means that the last date for voluntarily filing the ITR for the current financial year, i.e., FY 2020-21 will be December 31, 2021. Normally, income tax returns for a financial year have to be filed by July 31 of the following financial year (called the assessment year). Currently, belated and revised ITRs can be filed voluntarily after the normal deadline, up to March 31 of the assessment year.

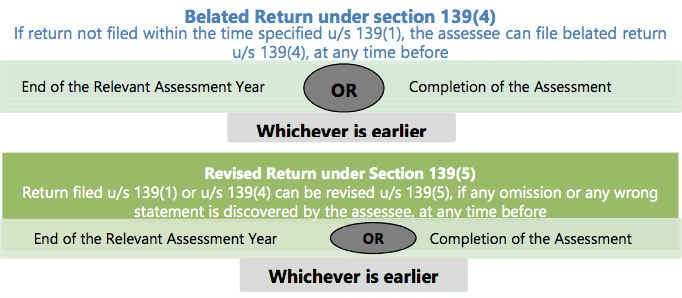

Belated return [Section 139(4)]

Any person who has not furnished a return within the time allowed to him under section 139(1) may furnish the return for any previous year at any time –

(i) before the end of the relevant assessment year; or(ii) before the completion of the assessment,

whichever is earlier. If an assessee has not submitted his return of income:

On or before the due date mentioned under section 139(1); orWithin the time allowed under a notice issued by the Assessing Officer under section 142(1)*,

He can still file the return of income. Such a return is called belated/late return. Belated return can be filed at any time:

Before the expiry of one year from the end of the relevant assessment year, orBefore the completion of the assessment,

Whichever is earlier. Example: Ram has a taxable income of Rs. 7,00,000 from salary in AY 2019-20. He files his return on 5th September 2019. His due date to file the return is 31st July 2019. Since he has filed it on 5th September 2019 it is a belated return. Ram can file his belated return anytime until 31st March 2020.

Revised return [Section 139(5)]

If any person having furnished a return under section 139(1) or a belated return under section 139(4), discovers any omission or any wrong statement therein, he may furnish a revised return at any time – If an assessee, after furnishing the return of income:

Under section 139(1), orIn pursuance of a notice under section 142(1), feels that he needs to revise the return of income, he can do so

Before the expiry of one year from the end of the relevant assessment year, or Before the completion of the assessment, “With effect from the financial year 2016-17, a belated return can be revised. For the financial year 2017-18, a belated return can be revised either before the end of the assessment year, i.e., end of the following financial year (August 31, 2019) or before the completion of assessment of the tax return by the tax authorities, whichever is earlier.”

Can a belated return under section 139(4) be revised:

There was a difference of opinion among various costs regarding filing of revised return in respect of belated returns. However, it has been held that a belated return filed under section 139 (4) cannot be revised as section 139(5) provides that only return filed under section 139(1) or in pursuance to a notice under section 142(1) can be revised [Kumar Jagdish Chandra Sinha v CIT (1996)220 ITR 67(SC)]. Thus, the conclusion is that a Belated Return can’t be revised. An income tax return or “return of income” not furnished on or before the due date is known as a belated return. Filing a belated income tax return attracts a penalty up to Rs. 10,000. A late filing fee of Rs. 5,000 is payable by the assessee for furnishing an income tax return after the due date (August 31) but before December 31 of the assessment year, according to the Income Tax Department’s website – incometaxindia.gov.in. In other cases, wherein an income tax return is filed after December 31 but before March 31, a late filing fee of Rs. 10,000 is applicable.

Can a revised return be further revised:

If the assessee discovers any omission or any wrong statement any revised return, it is possible to revise such a revised return provided it is revised within the same prescribed time [Lal Ram Chandra v CIT (1982) 134 ITR 352 (All); CIT v Shivastava (Dr.N) (1988) 170 ITR 556 (MP)] Thus, there is no limit on the number of times a return can be revised. Provided the same is done before the specified due date.

Revised return substitutes the original return:

Once a revised return is filed, the originally filed return must be taken to have been withdrawn and substituted by the revised return. [Dhampur Sugar Mills Ltd. v CIt (1993) 90 ITR 136(All)). Therefore, once you file the revised return successfully, your original return stands to be withdrawn. However, if the return is not filed before the due date, interest under section 234 A/ B/ C will be levied if it is a case of tax payment. Also, no matter what ever the consequences are, it is always beneficial to file the true & fair return on time & pay sufficient taxes before the due date. By doing this, you won’t need to pay any interest nor face any penalties or prosecution. Recommended Articles

Income Tax Due DatesWhat is Franking TDS Rate ChartOnline Verify For PANincometaxefilingHow to Pay TDS Online Full Guide and ProcedureForm 3CA 3CB 3CD In Word Excel & Java FormatPaying Tax is better than Saving Tax!Chapter VIA – All Deductions at a Glance