Why is the e-Way Bill required?

Section 68 of the Goods and Services Tax Act mandates that the Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed. Rule 138 of Karnataka Goods and Services Tax Rules, 2017 prescribes e-way bill as the document to be carried for the consignment of goods of value more than rupees fifty thousand . Government has issued a notification under rule 138 of Goods and Services Tax Rules, 2017 mandating to carry e-way bill for transportation of goods of consignment of value more than rupees fifty thousand. Hence e-way bill generated from the common portal is required to be carried.

Logging into e-Way Bill System

To open or login to the e-Way Bill system, user should have registered in the e-Way Bill system, if he is the GSTIN holder or he should have enrolled in the e-Way Bill system, if he is GST un-registered transporter. The user can read the our last post to know how to register or enrol into the e-Way Bill system. The user has to open the e-Way Bill portal and enter his username and password along with the displayed captcha. On successful authentication, the system shows him the main menu of the eWay Bill System.

Step by Step guide to Login at GST E-Way Portal

Step 1 : Please visit official GST E-Way portal i.e ewaybill.nic.inStep 2 : To access GST E-way portal you will require user name and password and you will get same by following our e-way registration article…Step 2 : Now Enter your username, Password and Security Code and then click on “Login” Button

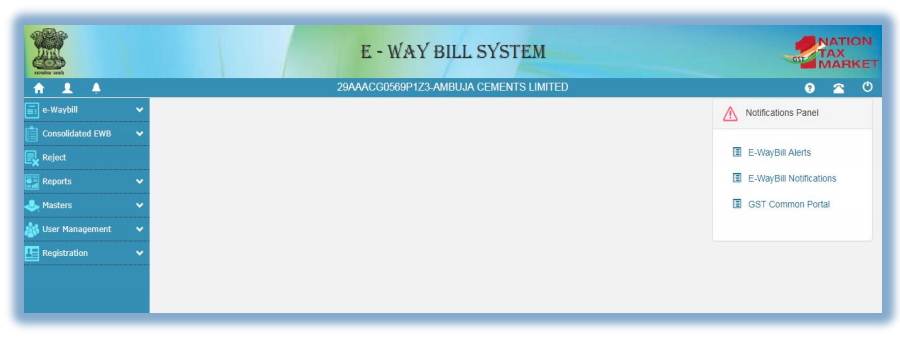

Main Menu after E-way login

The main menu lists the options available to a user to operate on the e-Way Bill. On the left hand side, the system shows the main options. They are:

e-Way bill – It has sub-options for generating, updating, cancelling and printing the e-Way Bill.Consolidated e-Way Bill – It has sub-options to consolidate the e-Way Bills, updating and cancelling them. Reject – It has the option to reject the e-Way Bill generated by others, if it does not belong to the user. Reports – It has sub-options for generating various kinds of reports. Masters – It has sub-options to create the users’ masters like customers, suppliers, products, transporters. User Management – It has sub-options for the users to create, modify and freeze the sub-users to his business. Registration – It has sub-options to register for SMS, Android App and API facilities to use.

The right hand side has the notification panel which notifies and alerts the user on various points about the e-Way Bill system. Recommended Articles

E-Way Bill Introduction, ScopeFeatures of the e-Way Bill SystemGST Council approves E-Way BillGST E-Way Bill RulesE-Way Bill RulesAnalysis on E-way BillGST E Way Bill Guide