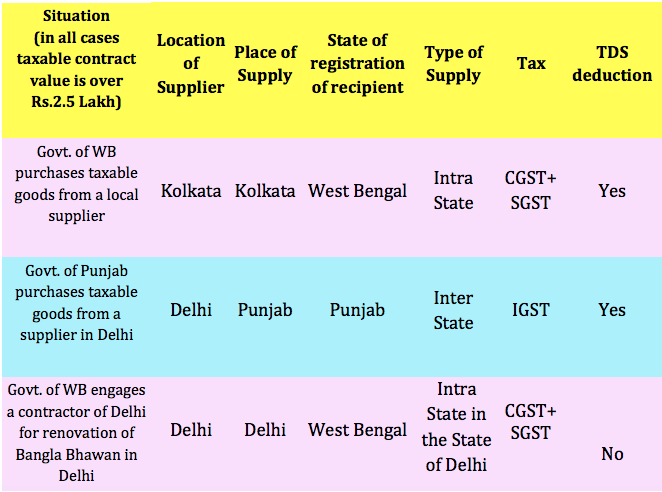

Examples of various situations requiring deduction of TDS under GST

Conditions for & amount of deduction:

Tax deduction is required if all the following conditions are satisfied a. Total value of taxable supply > Rs.2.5 Lakh under a single contract. This value shall exclude taxes & cess leviable under GST. b. If the contract is made for both taxable supply and exempted supply, deduction will be made if the total value of taxable supply in the contract > Rs.2.5 Lakh. This value shall exclude taxes & cess leviable under GST. c. Where the location of the supplier and the place of supply are in the same State/UT, it is an intra-State supply and TDS @ 1% each under CGST Act and SGST/UTGST Act is to be deducted if the deductor is registered in that State or Union territory without legislature. d. Where the location of the supplier is in State A and the place of supply is in State or Union territory without legislature – B, it is an inter-State supply and TDS @ 2% under IGST Act is to be deducted if the deductor is registered in State or Union territory without legislature – B. e. Where the location of the supplier is in State A and the place of supply is in State or Union territory without legislature B, it is an inter-State supply and TDS @ 2% under IGST Act is to be deducted if the deductor is registered in State A. f. When advance is paid to a supplier on or after 01.10.2018 to a supplier for supply of taxable goods or services or both. Recommended Articles

GST ScopeGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatGST Composition Scheme