A person should take a Registration, within thirty days from the date on which he becomes liable for registration, in such manner and subject to such conditions as is prescribed under the Registration Rules. A Casual Taxable person and a non-resident taxable person should however apply for registration at least 5 days prior to commencement of business.

1. I want take a Registration as a Casual Taxable Person but I can’t find the option.

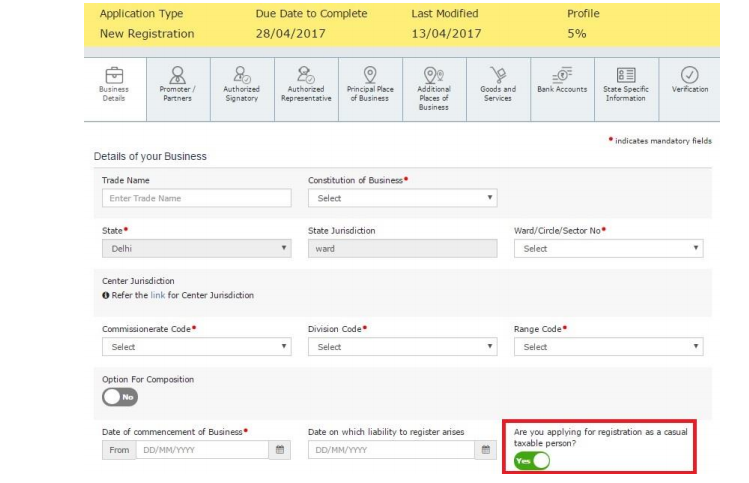

The option to register is in the New Registration Application form for a normal taxpayer. In PART A of the New Registration Application, select Taxpayer Reference screenshot (highlighted in red):

How do I obtain a GST Registration as a Casual Taxable Person?

To obtain a Registration as a Casual Taxable Person, follow these steps:

When should I apply for a Registration as a Casual Taxable Person?

You should apply for Registration as a Casual Taxable Person 5 days prior to the date of commencement of business.

How long is the Registration as a Casual Taxable Person valid?

Registration as a Casual Taxable Person can be granted for a maximum of 90 days.

Can I extend my Registration as a Casual Taxable Person?

Yes, you can extend your Registration as a Casual Taxable Person once for an additional period of 90 days if you apply before the expiration of the initial period. I have already extended my initial registration once and cannot extend it a second time as per prevailing laws. What do I do if my extension is about to expire and my business has not concluded? In such a case, you are required to obtain registration as a normal taxpayer in the concerned state. The moment I select Registration as a Casual Taxable Person option the New Registration Application forms asks me to fill a GST Challan. Why? In case of Registration as a Casual Taxable Person, you are required by law to deposit the tax in advance based on the estimated turnover for the period for which the casual registration has been obtained. A GSTIN will also be generated and prefilled in the challan. The status of this GSTIN will be provisional until your application is approved by the tax authority and the casual registration is officially granted. Is there a fixed amount I must deposit with the GST authorities before taking a Registration as a Casual Taxable Person? No, you are required by law to deposit the tax in advance based on the estimated turnover for the period for which the casual registration has been obtained. Recommended Articles