How to submit Response for Outstanding Tax Demand

Introduction- Once the e-Filed returns are processed and outstanding tax demand available in e-Filing portal, assessee is facilitated to submit the response against outstanding tax demand raised by CPC/AST. Process The detailed process to submit the Response to Outstanding Tax Demand is as below

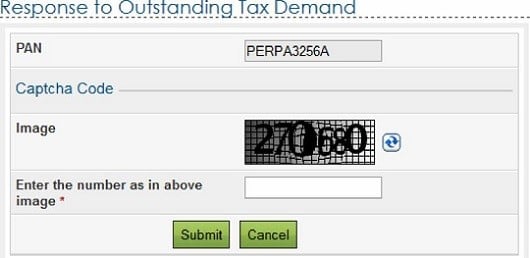

Logon on to incometaxindiaefiling.gov.in with your User ID, Password and Date of Birth/Incorporation.Go to e-File > Response to Outstanding Tax DemandEnter PAN andCaptcha code and click onSubmit button.

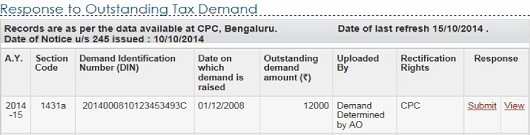

On success full validation if there is any Outstanding Tax Demand, the “Response to Outstanding Tax Demand” available with the following details

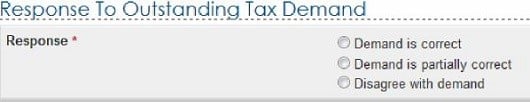

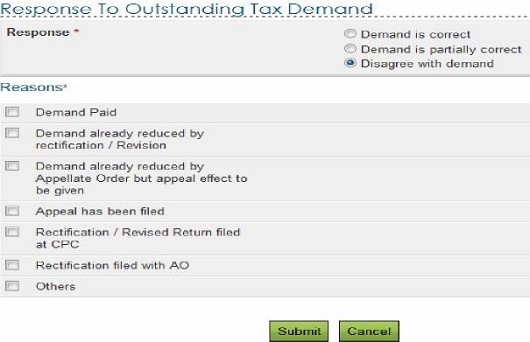

Assessee must click on ‘Submit link under Response column for the respective AY in order to submit the response. Assessee has to select one of the options from theradio button.

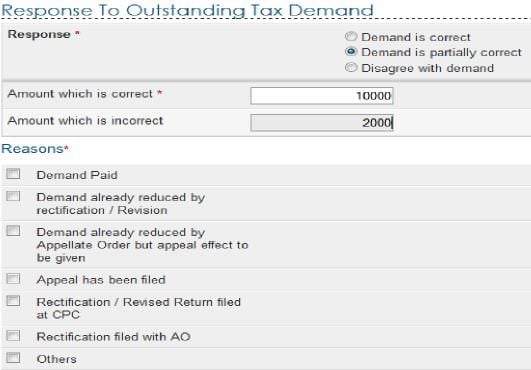

- If assessee selects “Demand is correct”, then a pop up is displayed as “If you confirm “Demand is correct’ then you cannot ‘Disagree with the demand’. Click on Submit. A success message is displayed and no further action is required.If assessee selects “Demand is partially correct´, then two amount fields will be available.

♠ Amount which is correct- Enter the amount which is incorrect. If the amount entered here is equal to the demand amount, then one pop is displayed “Since the amount entered is equal to outstanding demand amount, please select the option “Demand is correct” Note: If amount entered is equal to Outstanding demand amount than user shall not be allowed to submit with this option. Amount which is incorrect: Amount is auto filled which is the difference between the outstanding amount and Amount which is correct. ♠ Demand Paid –

Demand paid andchallan has CINDemand paid and challan has no CIN Demand already reduced by rectification/revision Demand already reduced by Appellate Order but appeal effect to be given Appeal has been filed Stay petition filed withStay granted byInstalment granted by Rectification / Revised Return filed at CPC Rectification filed with AO Others Based on the reason selected, the assessee needs to provide additional information as per the below table.

Note: Total Attachments size should be up to 50 MB.

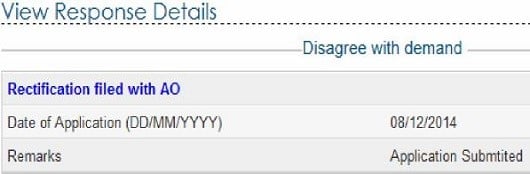

- f assessee selects “Disagree with the Demand” “, then assessee must furnishthe details for disagreement along with reasons. Reasons are same as provided under“Demand is partially correct”. Fill the necessary details and click on “Submit” button. Now you can Receive an Success Message

Transaction ID – Ahyper linkDate of ResponseResponse TypeClick on Transaction ID to know the details of response submitted

Note:

Demand position gets updated every dayInterest demand u/s 220(2) is linked to the principal demand of the same assessment This indicates that principal demand is already adjusted/ paid and interest demand is the only outstanding value. Hence does not require any confirmation.If demand is shown to be uploaded by AO in the above table, rectification right is with AssessingOfficer, please contact your jurisdictional Assessing Officer for the same.For the demand against which there is “No Submit response option” available such demand is already confirmed by the Assessing Officer. Kindly contact your Jurisdictional Assessing officer.

Recommended Articles

Income Tax Due DatesTDS Rate ChartPAN Name By PAN NoincometaxefilingHow to Pay TDS OnlineForm 3CA 3CB 3CD In Word Excel & Java FormatIncome Tax Slab RatesList of All Incomes Exempt from Income Tax