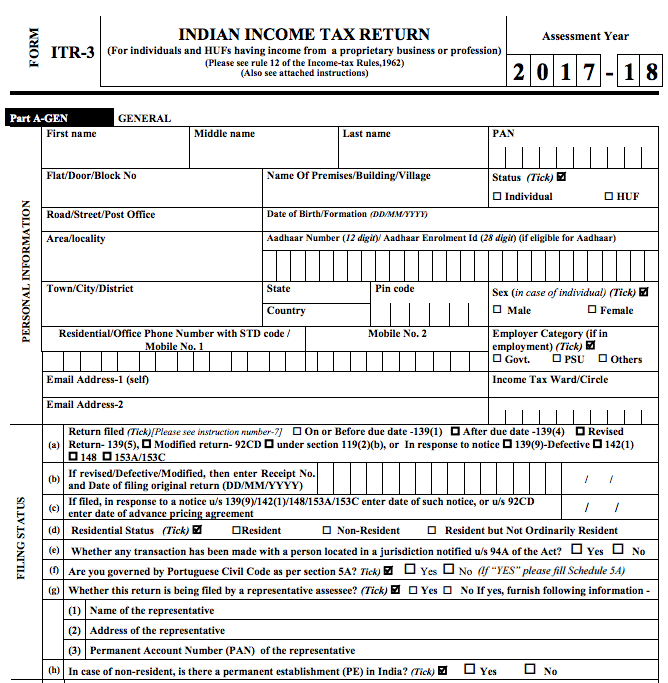

Instructions for Filing ITR 3 For AY 2017-18

1. Assessment Year for which this Return Form is applicable

This Return Form is applicable for assessment year 2017-18 only, i.e., it relates to income earned in Financial Year 2016-17.

2. Who can use this Return Form ITR 3?

This Return Form is to be used by an individual or a Hindu Undivided Family who is carrying out a proprietary business or profession.

3. Manner of filing this Return Form

This Return Form can be filed with the Income Tax Department in any of the following ways –

(i) by furnishing the return electronically under digital signature;(ii) by transmitting the data in the return electronically under electronic verification code;(iii) by transmitting the data in the return electronically and thereafter submitting the verification of the return in Return Form ITR-V.

It may be noted that where the books of accounts are required to be audited under section 44AB, the return is required to be furnished in the manner provided at 4(i). Tax-payers are advised to match the taxes deducted/collected/paid by or on behalf of them with their Tax Credit Statement (Form 26AS). (Please refer to www.incometaxindia.gov.in) From assessment year 2013-14 onwards in case an assessee who is required to furnish a report of audit under sections 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(via), 10A, 10AA, 12A(1)(b), 44AB, 44DA, 50B, 80 -IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E, 115JB or 115VW he shall file the report electronically on or before the date of filing the return of income.

4. Filling out the acknowledgement

Where the Return Form is furnished in the manner mentioned at 4(iii), the assessee should print out two copies of Form ITR-V. One copy of ITR-V, duly signed by the assessee, has to be sent by ordinary post to Post Bag No. 1, Electronic City Office, Bengaluru–560100 (Karnataka). The other copy may be retained by the assessee for his record.

5. Columns under Filing status

(i) Under the heading ‘Filing Status’ in the Return Form the relevant box needs to be checked regarding section under which the return is being filed on the basis of following.. (ii) If the assessee is governed by Portuguese Civil Code under section 5A of the Income-tax Act, schedule 5A is required to be filled out. Schedules relating to different heads of income should be filled out. However, while filling part B-TI (computation of total income) you should apportion the income (other than income from salary) and enter only your share of income under different heads. The balance share of income should be entered in the return of income of the spouse under respective heads. (iii) Under the head Audit Information, if the assessee is liable for Audit u/s 44AB and the accounts have been audited by an accountant, the details of such audit report along with the date of furnishing it to the department (if filed before the return) has to be filled. Further, if the assessee is liable to furnish other audit report, the section under which such audit is required and the date of furnishing it to the department (if audit has been carried out under that section) has to be filled. It is mandatory to furnish audit reports (if the audit has been carried out) under the following sections electronically on or before the date of filing the return of income.

Obligation to file return

(a) Every individual and HUF has to furnish the return of his income if his total income before allowing deductions under section 10A or section 10B or section 10BA or Chapter VI-A (i.e., if his gross total income referred to in item 10 of Part B-TI as increased by item 6 of Schedule 10A, item f of Schedule 10A and item f of Schedule 10A of this Form) exceeds the maximum amount which is not chargeable to income tax [Rs. 2,50,000/- in case of individuals below the age of 60 years and HUF, and Rs. 3,00,000/- in case of individuals who are of the age of 60 years or more but less than eighty years at any time during the financial year, and Rs. 5,00,000/- in the case of individuals who are of the age of 80 years or more at any time during the financial year].(b) The losses, if any, (item-18 of Part B-TI of this Form) shall not be allowed to be carried forward unless the return has been filed on or before the due date.(c) The deduction under sections 10A, 10B, 80-IA, 80-IAB, 80-IB and 80-IC shall not be allowed unless the return has been filed on or before the due date.

PART A-BS AND PART A-P&L

(a) The Balance Sheet as on 31st March, 2017 and the profit and loss account for financial year 2016-17 in the formats provided in these parts have to be filled in respect of proprietary business or profession carried out by you during the financial year 2016-17 if you were required to maintain accounts of the business or profession during the year.(b) If the matters other than proprietary business are not being accounted for in the books of the proprietary business or profession, these need not to be included in the balance sheet and profit and loss account to be filled in this Part.(c) In case, accounts of the business or profession were required to be audited, the items of balance sheet and profit and loss account filled in the these parts should broadly match with the audited balance sheet and profit and loss account.(d) In case, you were not required to maintain accounts of the business or profession during the year, please fill out the details mentioned in these parts against portion ‘No account case’.

Click Here to Download Complete Instructions or Item by Item Instructions Verification Please complete the Verification Section, fill date and Sign in the space given. Without a valid signature, your return will not be accepted by the Income- tax Department. Download ITR 3 For AY 2017-18 Download ITR 3 – PDF Format, Excel Format Recommended Articles

ITR FormsIncome Tax Slab Ratesincometaxefiling TDS Rate Chart Instructions for Filing ITR 4S SUGAMIncome Tax Due DatesAll Incomes Exempted from Income Tax