Key HighLights of Union Budget 2020

The FM has also continued the process of cleanup and making structural changes in the Budget without getting disillusioned by the negative political outcome of the previous measures. Other themes in the Union budget show a clear thrust towards improving the competitiveness of Indian businesses and Indian citizens while providing liquidity in the hands of individuals. Whether and how soon this will result in consumption revival will be interesting to watch.

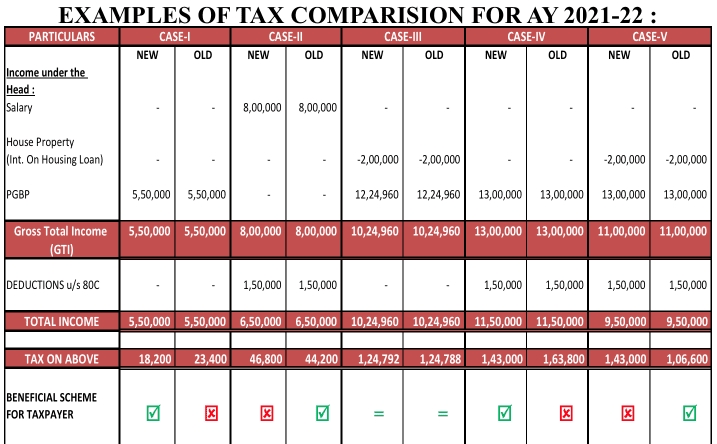

INCOME TAX SLABS FOR INDIVIDUAL & HUF

Remarks

a) Deduction u/s 87A shall be available under both the schemes where total income does not exceed 5.00-Lakhs.b) BasicE xemption Limit for Individuals aged b/w 60-80 years will be 3-Lakhs & Individuals aged above 80-years will be 5-Lakhs.c) The above New scheme of taxation is Several exemptions & deductions (Details in Next Slide) shall not be allowable if the individual opts for the New Scheme.

CONDITIONS FOR OPTING THE NEW SCHEME :

(Only an Illustrative List) Tuition Fees & Principal Repayment of Housing Loan. NOTE : The deductions not allowable under the New Scheme have been ignored for the tax computation. The same has been included in Total Income for comparison basis only.

CHANGE IN TDS & TCS PROVISIONS :

Section 194J :

It is to be noted that TDS Rate on Fees for Professional Services is same as before i.e. 10%.

Section 194O (New Section Inserted) :

Section 206C (New Section Inserted) :

The seller of an overseas tour programme package shall be liable to collect TCS at the rate of 5% from the buyer without any threshold limit.

AMENDMENT IN SECTION 44AB (TAX AUDIT

Every person carrying on business is required to get his accounts audited, if his total sales, turnover or gross receipts, in business exceed 1-crore rupees in any previous year. As per the amendment, the above turnover limit shall be relaxed to 5-crore rupees for the requirement of Tax Audit, provided :

a) Aggregate of all receipts in cash do not exceed 5% of total receipts &b) Aggregate of all payments in cash do not exceed 5% of total payments.

CHANGE IN DUE DATE

The due date of filing the return for the assessee shall be 31st October of the assessment year in the following cases :

a) A Company;b) A person whose accounts are required to be audited;c) A partner of the firm whose accounts are required to be audited.

Every person who is required to get his books of accounts audited u/s 44AB shall furnish theAudit Report one month prior to the due date of filing return u/s 139 (1).

MEASURES PROPOSED FOR TAXPAYER’S RELIEF

PROVISION FOR E-APPEAL : The filing of appeals before CIT (Appeals) has already been enabled in an electronic mode.However, the process that follows after filing of appeal is neither electronic nor faceless.Accordingly, An e-appeal scheme shall also be launched for disposal of appeal PROVISION FOR E-PENALTY : It is proposed to notify an e-scheme for the purpose of imposing penalty by eliminating the interface between the A.O. & the assessee INSERTION OF TAXPAYER’S CHARTER : It is proposed to insert a new section 119A in the Act to empower the Board to adopt and declare a Taxpayer’s Charter.

PREVENTION OF TAX ABUSE

MODIFICATION OF RESIDENCY PROVISIONS : Non-Resident Indians visiting India will be deemed as residents if their stay in India is 120-days or more during the previous year. Their global incomes shall also become taxable in India.Earlier, the same was 182-days or more. PENALTY FOR FAKE INVOICE u/s 271AAD : Recently, it is found that fake invoices are obtained by suppliers registered under GST to fraudulently claim ITC and reduce their GST liability. These invoices are found to be issued by racketeers & GST shown on such invoices is neither paid nor is intended to be paid. A penalty provision is proposed if it is found that there is a False entry or omission of entry in the books of account with the intention to use :

a) Forged or falsified documentsb) Invoice without actual supply of goods or services or both.c) Invoice from a person who do not exist.

The penalty payable by such person shall be equal to the aggregate amount of false entry oromitted entry.

REMOVAL OF DIVIDEND DISTRIBUTION TAX (DDT)

Domestic Companies & Mutual Funds are no longer required to pay any DDT u/s 115-O.The shareholders shall be liable to pay tax on the dividend received. The exemption u/s 10(34) & 10(35) shall no longer be available.

AMENDMENT TO CGST ACT

APPLICATION FOR REVOCATION OF REGISTRATION :

Any registered person, whose registration is cancelled by the proper officer on his own motion, may apply to such officer for revocation of cancellation of the registration within thirty days from the date of service of the cancellation order.

It has now been amended to provide that such period may, on sufficient cause being shown, be extended :

a) By AC/JC for 30-days;b) By Commissioner for further 30-days, beyond the period mentioned above.

Author

CA SAURABH MANGLANI+91 9623024089

Recommended

CA IPCC ResultCA Inter ResultCA IPCC Pass PercentageCA IPCC TopperCA Inter TopperCA IPCC Question Paper