It is empowered to hold properties in its own name. can sue and can be sued. But being an unnatural person, it cannot act by itself and consequently it has to depend upon to act in its name. Two human agencies through which a company functions are ‘members’ of the company and the ‘Board of directors’. The members have no inherent right to participate in day to day operations of the business. So, The Board of Directors is the managerial body to whom is entrusted the whole of the management of the company. But the directors do not provided free services and they needs to be remunerated suitably as per the provisions of the Companies Act, Rules, Schedules. Whether this remuneration payable to directors are subject to GST or not? In the following discussion we shall discuss about.

Legal aspects of Director’s remuneration in brief;GST provisions with respect to directors’ remuneration;Controversies in Advance Ruling; andIntersection of GST and Income Tax.

Directors Remunerations: Legal Aspects

As per Clause (34) of section 2 of Companies Act, 2013, directors means a director appointed to the Board of a company. As per clause(10) of section 2 of the Companies Act,2013 , ‘Board of Directors’ or ‘Board’ means a director appointed to the Board of company. Executive Directors and Non Executive directors: These two words have not been used in Companies Act, 2013. But we need to understand the meaning of these two terms.

A. Executive directors:

The directors who are in the whole time employment of the Companies are called as executive directors or inside directors. They are deeply involved in the day to day affairs of the company. Managing Directors or a Whole time directors are covered in this category.

B. Non-executive Directors:

Directors who are not in the employment of the company are called non-executive directors or outside directors. They include nominee directors or professional directors. They generally provide independent thinking, wider knowledge and perspective to the company. Non-executive Directors are the independent directors. As per Section 2(54) of Companies Act, 2013 ‘Managing Director’ means a director who, by virtue of the articles of company or an agreement with the company or a resolution passed in general meeting , or by its board of directors is entrusted with substantial power of management of the affairs of the company and includes a director occupying the position of a managing director, by whatever name called. As per Section 2(94) of Companies Act, 2013, ‘Wholetime director’ includes a director in the whole time employment of the company.

What is Directors Remuneration (Managerial remuneration) :

Remuneration means any money or its equivalent paid to any person for services rendered by him and includes perquisites. Director’s remuneration is the emoluments by which directors of a company are compensated, either through fees, salaries, or the use of company’s assets with the approval of shareholders and Board. Managerial remuneration means remuneration paid to the managerial persons. Here, managerial persons mean directors, including managing director (MD), whole time director (WTD) and manager (M). The directors’ remunerations can have following components.

a) Fees for attending various meetings (sitting fees).b) Reimbursement of expenses for attending board or committee meeting.c) Salary as per the terms of the employments.d) % of profit as bonus.e) Stock Option: to buy share at a fixed price or exercised price.f) Benefits in kinds: Like transport, health provisions, accommodations etc.g) Contribution to PF, Superannuation, Gratuity, leave encashment.h) Children educations allowance, leave travel concession etc.

Managerial remuneration : Ceiling of payment.

The upper limits of managerial remunerations are broadly determined in following two ways.

A) Company having profits in the Financial Year : pay remuneration as per Section 197 of Companies Act, 2013.B) Not having or inadequate profits in any Financial year: Pay as per Section II of part II or Schedule V

A. Section 197: Total Remuneration payable by a public company: Maximum 11% of the ‘Net profit’ for that FY

How to Calculate Net Profit for Managerial Remuneration

Other Important Points

All the above mentioned remuneration should be exclusive of ‘sitting fees’.The remuneration payable to the directors and managers of accompany shall be determined a) By the articles of association of the company; or b) By an ordinary resolution; or c) By special resolution where articles so require.

B. Not having or inadequate profits in any Financial year: Pay as per Section II of part II or Schedule V The remuneration shall be calculated as per the following scale: For more details, please refer the Companies Act, 2013

GST provisions with respect to directors’ remuneration

Better we start the discussion with the GST provisions when any remuneration is paid by an ‘Employer’ to its ‘ Employee’ Section 7(1) of CGST Act, 2017 defines the scope of ‘supply’. As per section 7(2), activities or transactions specified in Schedule III shall be treated neither as ‘supply of goods’ or ‘supply of services’.

As per Schedule III point no. 1

‘Service by an employee to his employer in the course of or in relation to his employment’ should not be considered as supply of service and GST will not be charged. So when any amount is paid out of the ‘employer’ ‘employee’ relationship, it is outside the purview of the GST. Other Important points to be considered.

- Schedule II, Point 5 : specified certain activities as supply of services. Point 5(e) is read as follows ‘Agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act.’ ‘Notice Pay’ by employees fall under this category and subject to GST

- Considering the press release dated 10th July, 2017 common facilities provided by the employer to its employees without any recovery would not be subject to GST as they are not gift. Examples of such are: Transport facilities, Internet facilities, Mobile services, training facilities, parking facilities, uniform, office tour etc.

- But when any partial amount is recovered, it should be considered as supply. Example, Company provides bus facility for its employees. The cost of such transport shall be borne by the employer and employees in equal proportion. The transport contractor is paid by the employer but 50% is recovered from employees from their salary. This recovered amount is considered as ‘supply of service’ and should be subject to GST. So, the main crux of the issue is that when any amount is paid out of employer-employee relationship, GST should not be attracted

Notification No 13/2017 – Central Tax (Rate) dated 28th June, 2017

This notification specifies the categories of supply of services in respect of which GST will be paid by the recipient of services under RCM as per Section 9(3) of CGST Act, 2017. As per this notification, The service supplied by a director of a company or a body corporate to the said company or body corporate, the Company or the body corporate is liable to pay GST under RCM. If we analysis the Notification, no distinction has been made between the ‘employee director’ and ‘outsider / independent directors’. This has created huge controversies on this subject matter as discussed below.

3. Controversies in Advance Ruling

As per GST provision, the advance ruling is a written decision given by the tax authorities to an applicant on questions relating to the supply of goods /services, rate of tax, taxability of a transaction etc. In the Question, whether the ‘director’s remuneration’ is subject to GST, Two different Advance Ruling Authorities (AAR) of two different stats have given contrary verdict. Let us discuss the issue and ruling pronounced.

A: Advance Ruling by Rajasthan AAR

Intersection of GST and Income Tax

The above mentioned differences and controversies have come to an end. The Central Board of Indirect Taxes and Customs ( CBIC), by issuing a circular on 10th June,2020 puts an end to such ambiguity. b) Whether it will make any difference if the director is also a part time director of any other Company. CBIC has examined the issue of remuneration to directors in two different categories.

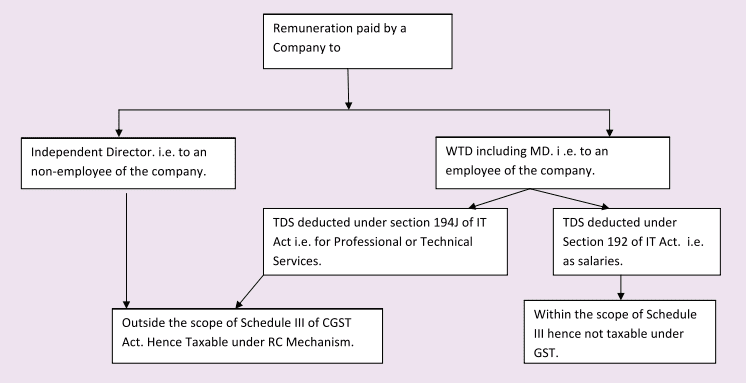

A) The first one refers to the independent directors ( outside directors not in the employment of the company)B) Second one includes whole-time directors including Managing Director, who are employees of the company.

The norms finalized are as follows.

“ In respect of such directors (independent directors) who are not the employee of the said company, the services provided by them to the company, in lieu of remuneration as consideration for the said service are clearly outside the scope of Schedule III of CGST Act and are therefore taxable.”The circular further said, it will be the responsibility of the company to discharge the applicable GST on ‘Reverse Charge basis’. Rate of tax is 18%.For Whole time director, including MD, working as employee of a company, the remuneration can be divided into two parts. “The part of Directors’ remuneration which are declared as ‘Salaries’ in the books of a company and subject to TDS (Tax deducted at sources) under section 192 of Income Tax Act, are not taxable being consideration for services by an employee to the employer in the course of or in relation to his employment in terms of Schedule III of CGST act, 2017,” It means there is no GST on this component.However, the part of the employee Director’s Remuneration, which is declared separately other that ‘salaries’ in the company’s accounts and subject to TDS under Section 194J of IT Act as ‘ Fees for Professional or Technical services’ shall be treated as consideration for providing services which are outside the scope of Schedule III of CGST Act,2017 and is therefore, taxable. Company will discharge liability under RC mechanism

The above provisions can be tabulated in the following manner.

Conclusion:

So, CBIC has finally put to rest the huge hustle created the contrary ruling on this subject matter. It has been clarified that the litmus test to determine whether remuneration paid to the directors are subject to GST will depend upon the section under which the TDS is deducted under Income Tax Act. If TDS is deducted under Section 192, not GS on the remunerations paid as it is considered as salaries. But if TDS is deducted under Section 194J, the remuneration cannot be said to be in the course of employment and hence subject to GST and will be paid by the company under Reverse Charge mechanism. The rate of GST as per the circular is 18%.