Thin Capitalization Rules in International Taxation

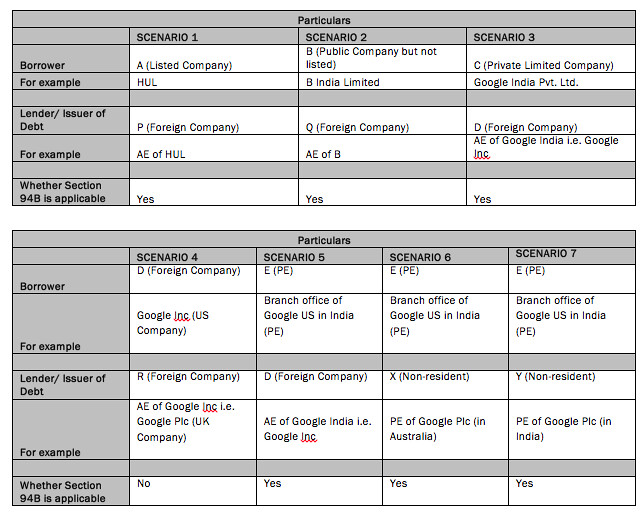

Latest Amendment ⇒ It is proposed to limit interest deduction if the following conditions are satisfied:

Interest expense claimed by taxpayer is more than INR 1 crore (INR 10 million or USD 1,48,372[1])Such Interest expense is paid / payable to its associates enterprises (non-resident)

The key features of proposed amendments are as follows:

Interest expenses claimed by any entity to its associates enterprises restricted to 30% of its EBITDA or interest paid or payable to associates enterprises whichever is less. Applicable if the Borrower is ⇒ Indian Company or Permanent establishment of a foreign Company in India.Applicable if the Lender is (i.e. Debt issued to) ⇒ Non Resident or to a permanent establishment of a non-resident and who is associated enterprisesIt is proposed that the debt be deemed to be treated as issued by a related party where it provides an implicit or explicit guarantee to the lender or deposits a corresponding and matching amount of funds with the lender.Un-allowed/ un-absorbed portion of interest is proposed to be ⇒ allowed to carry forward for eight assessment years immediately succeeding the assessment year for which the disallowance was first made.Maximum allowance in subsequent years is ⇒ limited to maximum allowable interest expenditure in that particular year.This restriction is not applicable on banks and insurance business.

ANALYSIS WITH PRACTICAL ILLUSTRATION:

Refer ANNEXURE BRefer ANNEXURE CAnuraag Singhaal CA (2005) & CPA (USA)(2008)11 Years of Work Experience with PwC (Big 4), Deloitte (Big 4), Reliance Industries GroupBest-in-class Faculty for Direct Taxes (DT) CA FinalFor Batches & Sessions, contact at 9582039221 [/author]

Key Analysis ⇒

These rules in common language may be called as THIN CAPITALIZATION RULES.

TO UNDERSTAND WHAT IS THIN CAPITALIZATION RULES, REFER PRACTICAL ILLUSTRATION AT ANNEXURE D.

The move is aimed at bringing India’s tax regime in line with the recommendations contained in Action 4 of the OECD/G20 base erosion and profit shifting (BEPS) project.The Action 4 is primarily designed to target cross-border profit shifting through excessive interest payments, and as a result, protect the tax base.This provision is applicable in computing a company’s profit for tax purposes.This provision does not impact computation of book profit which is to be computed considering relevant accounting principles.Secondly, for computing Minimum Alternative Tax (‘MAT’), this limitation on interest would not be applicable. In other words, one can claim interest deduction without any limit for computing MAT.

Date from which amendment is applicable ⇒

e.f. April 1, 2018 i.e. applicable for AY 2018-19 and subsequent assessment years.

[1] converted at INR 67.3981 = USD 1 Annexure B (Please check Below Image) Annexure C (Please check Below Image)

Annexure D

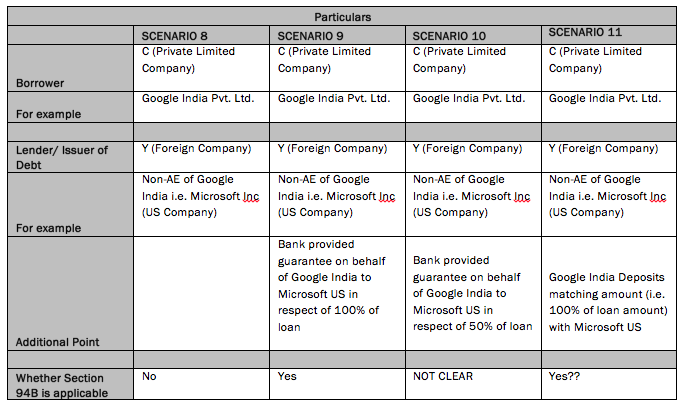

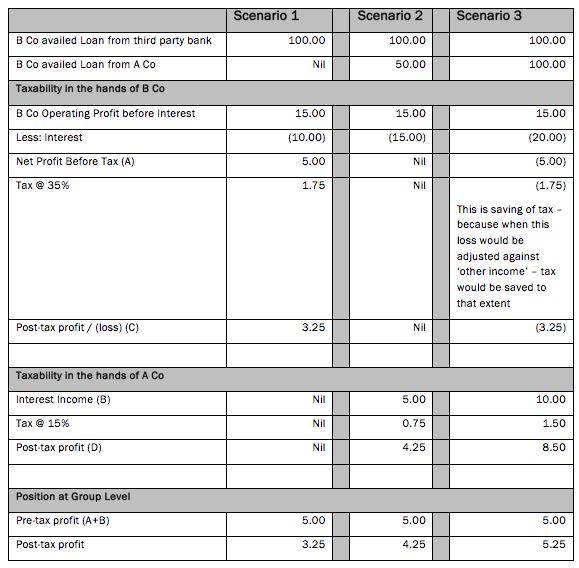

Example of loan availed by Indian Entity – See how thin capitalization impact Scenario 1

A Co is resident in a country with a 15% rate of corporate income tax and B Co is resident in a country with a 35% corporate tax rate.B Co borrows USD 100 from a third party bank at an interest rate of 10%.B Co uses these funds in its business and generates additional operating profit of USD 15.After deducting the USD 10 interest cost, B Co has a pre-tax profit of USD 5 and a post-tax profit of USD 3.25.

Scenario 2

A Co could also replace USD 50 of existing equity in B Co with a loan of the same amount, at an interest rate of 10% (the same rate as on the loan from the third party bank).In this case, B Co has a pre-tax and post-tax profit of nil.A Co has interest income on its loan to B Co, and has a pre-tax profit of USD 5 and a post-tax profit of USD 4.25.The group has reduced its effective tax rate from 35% to 15% by shifting profit from B Co to A Co.

Scenario 3

Taking this one step further, A Co could replace USD 100 of existing equity in B Co with a loan of the same amount.Assuming B Co can set its interest expense against other income, as a result of this transaction B Co now has a pre-tax loss of USD 5 and a post-tax loss of USD 3.25 (it means doing a saving of USD 1.75).A Co receives interest income from B Co, and has a pre-tax profit of USD 10 and a post-tax profit of USD 8.50.Taken together, A Co and B Co have a pre-tax profit of USD 5 and a post-tax profit of USD 5.25.As a result of thinly capitalising B Co and shifting profit to A Co, the group is now subject to a negative effective rate of taxation.

Please check Below Image Other Articles on International Taxation & Transfer Pricing

CA Final New SyllabusTransfer pricing secondary adjustments – Section 92CETransfer PricingTransfer Pricing Definition & Transfer Pricing MethodsTransfer Pricing Case StudiesList of All Incomes Exempted from Income Tax, List of Exempted IncomesRestriction on set-off of loss from House property : Section 71(3A)

If you have any query or suggestion regarding “Thin Capitalization Rules in International Taxation – Transfer Pricing Series” then please tell us via below comment box….